OctaFX offers leveraged trading on the MT4, MT5 and cTrader platforms. In this review, we break down the broker’s offering, from the sign-up process and spreads to copy trading, withdrawals and customer support. Use this guide to find out whether OctaFX can meet your swing trading needs.

What Is OctaFX?

Company Details

OctaFX is a forex and CFD broker registered as two separate legal entities. One has headquarters in Cyprus, regulated by the CySEC, and the other is based offshore with its head office in St. Vincent & the Grenadines, regulated by the territory’s FSA. The founder and owner has also set up a support office in Jakarta, Indonesia.

The Cypriot branch of OctaFX, for European clients, is considered safe, as the CySEC imposes fairly stringent rules on trading brokers. However, customers registered with the firm’s St. Vincent arm will not receive the same degree of legal protection.

History

Founded in 2011, OctaFX is a popular online brokerage with over 1.5 million trading accounts opened worldwide. The broker is an established firm with a long list of awards to its name. The brand has also expanded its suite of trading products over the years, with OctaFX now offering copy trading and access to a decent range of financial markets.

OctaFX Platforms

Investors can choose from three live accounts at OctaFX, each providing access to different trading platforms. The broker primarily uses the MetaTrader suite, available on the Micro (MT4) and Pro (MT5) accounts. Generally, MT4 is considered the superior forex platform, while MT5 is best for CFD trading. Note, MT4 is available to non-EU clients only. To use the cTrader platform, customers must sign up for the ECN account.

Each of the three accounts has different minimum deposit requirements, pricing structures, and available assets, which will be outlined later in this review.

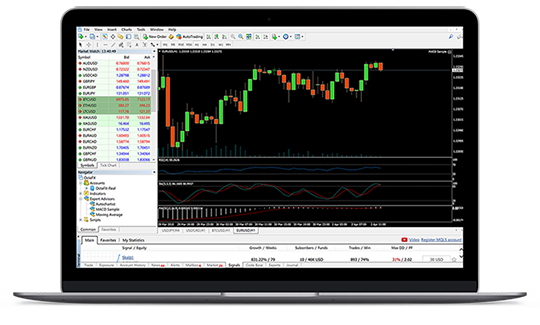

MT4

MT4 is the most popular forex trading platform worldwide, highly regarded for its ease-of-use, reliability, and solid range of technical tools. Clients can choose from over 30 pre-installed indicators and several automated trading bots (known as Expert Advisors). Additional bots and indicators can be built using the MQL4 programming language or bought on the MetaTrader Marketplace. The platform also features a live news feed and customisable trading alerts.

MT4 offers:

- Four order types (Buy Stop, Sell Stop, Buy Limit, Sell Limit)

- Three interactive charts and graph types

- Straightforward customisation

- Detailed historical data

- One-click trading

MetaTrader 4

MT4 is available as both a Mac and Windows PC (desktop) client. Investors can also use the MetaTrader web application.

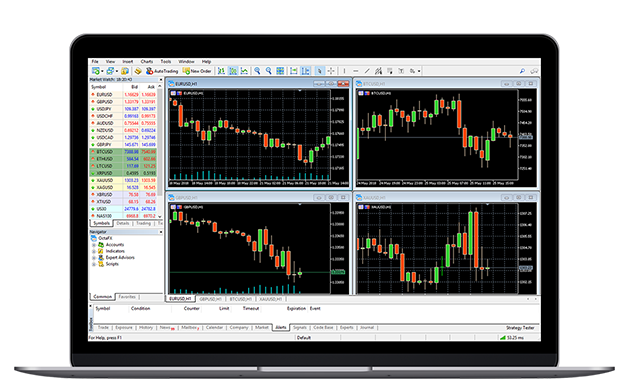

MT5

MT5 is the most recent update to the MetaTrader suite, primarily targeted at CFD traders. The platform offers more sophisticated trading tools than its predecessor, although newer traders may find the investment solution more difficult to use.

OctaFX traders who opt for MT5 can access over 100 price charts, 80 technical indicators, plus six order types. Like MT4, MT5 supports automated trading.

The platform also features:

- 21 timeframes and 44 graphical objects

- Live news feed and market data

- Fully customisable interface

- Multiple languages

- Level 2 pricing

MetaTrader 5

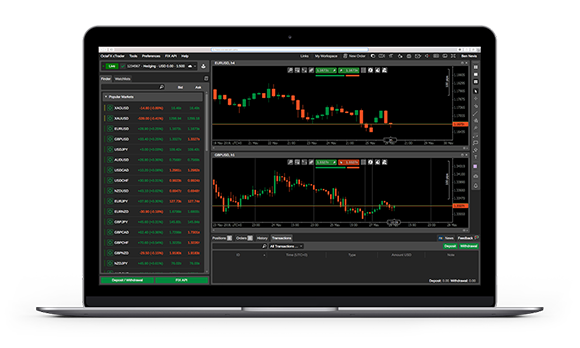

cTrader

Clients who opt for the ECN account can use cTrader, an advanced trading platform with a clean, modern design. cTrader boasts 54 timeframes (in contrast to MT4’s nine) and three types of market depth.

In addition, traders can use 70 technical analysis indicators and implement algorithmic trading through cBots. The platform also has a 3ms internal processing time, making it one of the fastest terminals available to retail traders.

cTrader offers:

- Detailed symbol information and live sentiment data

- Advanced take profit and stop loss orders

- Wide range of charts

- Simple navigation

- Level 2 pricing

cTrader

Copy Trading

Copy trading, also known as social trading, allows customers to imitate profitable investors. To diversify portfolios, users can essentially mirror multiple traders and follow established swing trading strategies.

It’s easy to find and subscribe to successful traders on the OctaFX Copy Trading app or web-based client. Fees are competitive and users can retain control over trade parameters, such as order size plus stops and limits. Alternatively, high-performing traders can make money by attracting followers.

Mobile Trading

Our review was pleased to see that customers looking to trade from their phone can download the mobile versions of MT4, MT5, and cTrader onto their iPhone (iOS) or Android (APK) devices.

Each of the applications is well-designed and interactive, with a good selection of chart types and tools, allowing clients to monitor and execute trades remotely. The applications are also free to download and the broker’s copy trading service is available on mobile and tablet devices too.

Markets

Traders can access a decent selection of markets and assets, including 28 currency pairs, 10 CFDs on indices (like the US30), 3 cryptocurrency CFDs (including Bitcoin), plus a few commodity CFDs (such as crude oil, gold, and silver). The forex offering includes most popular pairs like EUR/USD and USD/GBP.

Each OctaFX account has a slightly different product offering:

- Micro Account (MT4): 28 forex pairs, 2 metals, 4 indices, 5 cryptocurrencies

- Pro Account (MT5): 28 forex pairs, 2 metals, 2 energies, 10 indices, 5 cryptocurrencies

- ECN Account (cTrader): 28 forex pairs and 2 metal CFDs

The minimum trade volume for all OctaFX accounts is 0.01 lots and there is no maximum order size.

Spreads & Fees

On the MetaTrader accounts, OctaFX takes its cut from the spread – the difference between the bid and ask price. Spreads are competitive on major currency pairs such as the EUR/USD, at 0.7 and 1.1 pips on the Micro and Pro accounts respectively. The Pro account generally offers tighter spreads on CFDs, starting at 2.0 pips for gold and 3.5 pips for major indices like the NASDAQ (NAS100). Fixed spreads are available on the Micro account.

The ECN account has a different pricing structure, with fees primarily taken through a commission of 0.03 USD per 0.01 lot. In return, there is no spread charged to clients.

Rollover fees apply to positions held for longer than three days. Inactivity fees are not charged to dormant accounts.

OctaFX Leverage

Leverage allows traders to borrow money against the future price of an asset, reducing the amount of capital needed to open a position.

Clients of OctaFX’s St. Vincent-based arm can access high leverage rates – up to 1:500 on the Micro account, 1:100 on the Pro account, and 1:500 on the ECN account. In the EU, leverage is capped at 1:30 and lower for forex pairs and CFDs.

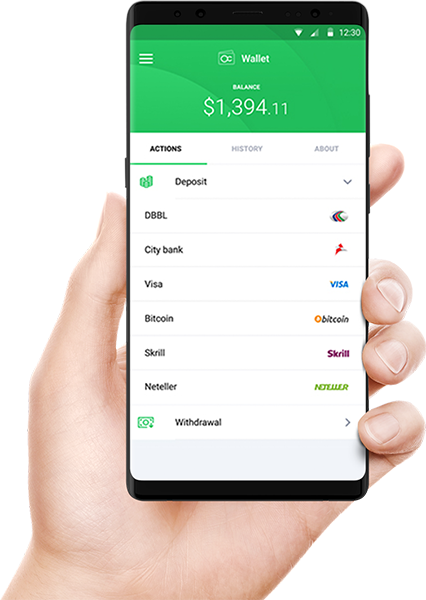

Payments

Deposits

OctaFX has low minimum deposit requirements, starting at 100 USD for the Micro and ECN accounts, and 500 USD for the Pro account. Payment methods vary depending on your home origin country, but Visa, Perfect Money, Bitcoin, FasaPay, local bank deposits and transfers, plus Neteller, Skrill, and UnionPay are generally accepted. Deposits are usually transferred within minutes.

Withdrawals

OctaFX does not charge fees on deposits or withdrawals, except for 0.5% on Perfect Money transfers. Withdrawals are usually processed within one working day. There is no withdrawal limit. Head to the members’ area from your desktop or mobile device to request a transfer.

Demo Account

Our review was pleased to see that new clients can test out strategies with OctaFX’s free demo account, pre-loaded with an unlimited amount of virtual capital. This allows beginners to learn the market dynamics of swing trading in a risk-free environment. Registration for a paper trading account is available on the broker’s website.

Bonuses & Promos

Outside the EU, OctaFX offers a number of attractive incentives to new clients, including a 50% and 100% deposit bonus. The company also runs competitions, most notably the 16 Cars Real Contest where traders are entered into a prize draw every three months. OctaFX branded t-shirts and tech gadgets are also regularly up for grabs.

In addition, trading tournaments are held through the broker’s demo account, offering entrants a chance to test their financial acumen and win prizes.

OctaFX Trading Hours

Trading hours for the Micro and Pro (MetaTrader) accounts are 24/5, from 0:00 Monday to 23:59 Friday (time zone EET/EEST). Alternatively, the ECN (cTrader) server time zone is UTC +0 by default, though it is possible to set and customise the time displayed on the platform.

Customer Support

The OctaFX customer care team, available 24/5 (EET), can be contacted by:

- Email: support@octafx.com

- Customer Care Phone Number (EU): +357 25 251 973

- Customer Care Phone Number (Non-EU): +44 20 3322 1059

- Live Chat: located at the bottom of the OctaFX webpage

The customer service team are quick to respond and helpful. The team can answer questions on a range of topics, including account opening, your withdrawal pins, the personal area, off quotes errors, how to delete an account, and more.

Security

OctaFX uses 128-bit SSL encryption and PIN codes to protect personal details across its platforms. The company also uses 3D secure Visa authorisation for processing card transactions.

EU-based clients of OctaFX (those registered with its Cyprus-based entity) are entitled to investor insurance through the ICF fund, protecting trader capital in the event that an exchange goes bankrupt. European traders also benefit from negative balance protection. In addition, the firm holds client funds in segregated accounts.

Traders should be warned, however, that St. Vincent and the Grenadines imposes little to no regulation on its brokers, meaning that funds may not be well-protected.

OctaFX Education

The educational resources on offer are mostly limited to platform tutorials, with 19 articles available on the OctaFX website. The broker’s blog and trading YouTube channel also cover a decent range of topics suitable for novice traders. Still, individuals looking for advanced tips on forex and CFD trading may be left wanting more.

In addition, the brokerage’s website is home to a profit and margin calculator, plus a free forex signals service via the AutoChartist plugin. There is also a trading glossary, economic calendar, and FAQ section.

Pros

If you take OctaFX vs HotForex, FBS, XTB, OlympTrade, FBS, Exness, Zerodha, Wazirx and other competitors, there are multiple benefits to opening an account:

- Copy trading and algo-trading supported on iOS & APK

- Free demo account with unlimited virtual cash

- Choice of MT4, MT5, or cTrader

- ECN account with zero spreads

- Telephone helpline number

- No withdrawal problems

- Fast withdrawal times

- Free gifts & giveaways

- KYC verification

- ZAR account

- VPS services

- Secure login

- Live quotes

Cons

Drawbacks of trading with OctaFX include:

- Tighter spreads with non-ECN accounts available elsewhere

- Limited product range

- Not FCA regulated

OctaFX Verdict

OctaFX is a legitimate forex and CFD broker offering high leverage across a modest selection of assets. A user-friendly copy trading service plus sign-up bonuses are also available. The limited education offering may deter some traders but overall, OctaFX is a strong choice for swing traders.

FAQ

Is OctaFX Halal Or Haram?

OctaFX offers a swap-free Islamic account for Muslim traders. This means no overnight charges are applied to open positions.

What Are OctaFX’s Brokerage Charges?

The Pro and Micro accounts take a fee solely through the spread, while the ECN account has fixed commissions per lot. The broker does not charge deposit, withdrawal, or inactivity fees. Overall, spreads and commissions are in line with the industry.

Can I Trade Cryptocurrencies With OctaFX?

OctaFX does not allow clients to buy cryptos directly. Instead, customers can trade three crypto-based CFDs (Bitcoin, Ethereum and Litecoin). Leverage is also available to crypto traders.

How Do I Use The OctaFX Joining Bonus?

Welcome bonuses at OctaFX change regularly. New promo codes can be found on the broker’s website. Make sure to read bonus terms and conditions before you sign up and start trading.

Is OctaFX A Good Forex Broker?

OctaFX is a well-rounded broker, with relatively low spreads and leveraged trading opportunities. The brand also offers multiple account options to suit client needs. With that said, its offshore arm, based in St. Vincent & the Grenadines, is unregulated, with a limited range of trading products. Note, OctaFX is not a market maker.