IG Group is a top-rated online broker specialising in derivatives trading. The brokerage is an established member of the UK FTSE 250 and is regulated by the Financial Conduct Authority (FCA). This 2025 review will cover the account sign-up and login process, minimum deposit requirements, educational content and more. Find out whether to register for an IG trading account today.

What Is IG Group?

Company Details

The IG Group was established in 1974 and incorporated as IG Group Holdings Plc on Companies House in 2003. The company operates in more than 20 countries worldwide with the number of clients topping 400,000. The firm has office locations in London, Hong Kong, Melbourne, Bangalore, Johannesburg, Zurich and Geneva. Additional trading brands owned by the IG Group include Tastytrade and Nadex in the USA plus Spectrum in the EU.

The number of IG employees currently exceeds 2,000 with notable executive team names including CFO, Charles Rozes. The Board of Directors includes the likes of Jon Noble, Karen Toh and June Felix.

History

Originally IG Index, the broker was the UK’s first over-the-counter (OTC) leveraged derivatives provider. By 1974, the company had introduced a new, accessible way to trade gold via an index, leading to a surge in popularity.

In 2000, IG Group was listed on the London Stock Exchange (LSE) under IG Group Holdings PLC, ticker IGG. According to Yahoo Finance, the current share price is around 800 GBP while the firm has a market cap of more than £3.45 billion.

Recent annual reports show strong profits and growth with an upcoming focus on ESG initiatives. Following the publication of its 2021 full-year results, the broker has pledged that 1% of post-tax profits will be donated to global charities until year-end 2025.

The full IG Group investor relations presentation can be found on the broker’s website. Details include debt investors with disclosures on the EMTN programme and bonds issuance, yearly dividend payment dates, AGM updates, and analyst consensus forecasts.

Markets

The IG Group offers swing trading opportunities on 17,000+ assets:

- Forex – Speculate on 200+ currency pairs including majors, minors and exotics

- Shares – Invest in 16,000+ global shares including Tesla Motors, Gamestop and Lloyds Banking Group

- Commodities – Access trading opportunities on 35+ hard and soft commodities including metals, energies and agriculture

- Global Indices – Speculate on 80+ of the world’s largest index groups including the FTSE 100 and 250, Germany 30 and US 500

Note, market access will vary by country of residency. For example, UK clients have access to real equities and spot stocks. Additional markets that vary by region include ETFs, IPOs, Thematics, Sectors, Bonds and Interest Rates. IPOs can be participated in via the Grey Market or after the IPO.

Turbo24 is also available to clients in some European countries including France and the Netherlands. This exchange-traded product allows a knock-out level to be set – the price at which a position will be liquidated.

CFDs & Spread Betting

The broker offers two primary trading vehicles; spread betting and CFDs. Both offer 24-hour dealing, no stamp duty and pricing based on the underlying market.

- CFDs – Direct market access on shares and forex

- Spread Betting – Trade without paying capital gains tax. Pay spreads only and bet in a chosen currency

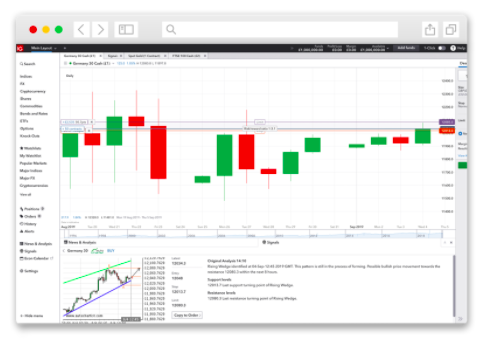

Trading Platforms

IG Group PLC offers two trading platforms; a proprietary solution and the industry favourite MetaTrader 4 (MT4). The bespoke terminal is compatible with all major web browsers. Similarly, MT4 can be used via browsers or can be downloaded to desktop devices. A useful platform comparison table is available on the broker’s website to help traders decide which solution to go for.

IG Web Trader

An award-winning trading platform suitable for new or experienced investors. Available products include spread bets, CFDs and share dealing. Our review was pleased with the fully customisable interface, intuitive design and fast execution.

Features include:

- One-click trading

- Portfolio and fee reports

- Create custom watchlists

- In-built news and analysis

- Perform in-depth analysis with 28 indicators

- Buy/sell signals and chart pattern recognition

- Compare up to four timeframes on a single chart

- Stable trading supported by HTML5 technology

- Live and on-demand shows from in-house TV channel

- Five order types including market order, stop-loss and guaranteed stop

- Automated alerts for price moves, economic events and technical patterns

MetaTrader 4

A globally established trading platform. Clients can use the terminal for spread betting and trading CFDs. The MT4 platform promises an easy-to-use design with practical navigation tools.

Features include:

- Nine timeframes

- Multilingual interface

- Fully customisable charts

- Four pending order types

- Three order execution types

- Pattern recognition alerts

- MQL4 programming language

- 30+ built-in technical indicators

- Automated trading via Expert Advisors

- Access to Autochartist pattern recognition tool

IG offers free MT4 indicators and add-ons as part of their package. These include order history indicators, chart group indicators and freehand drawing. Add-ons include a sentiment trader, correlation trader and candle countdown.

ProReal Time

IG users can access a leading web-based charting package designed for technical analysis. Build algorithms to execute trades 24 hours a day. The solution can also be integrated with the IG Web Trader platform.

Features include:

- Backtest strategies using 30 years of historical data

- Build algorithms with in-app guidance or from scratch

- Options functionality – scenario tool and chain window

- Full platform customisation including chart colouring and custom market trading hours

- Technical analysis tools – ProReal Trend, easy order placement, ProScreen and custom indicators

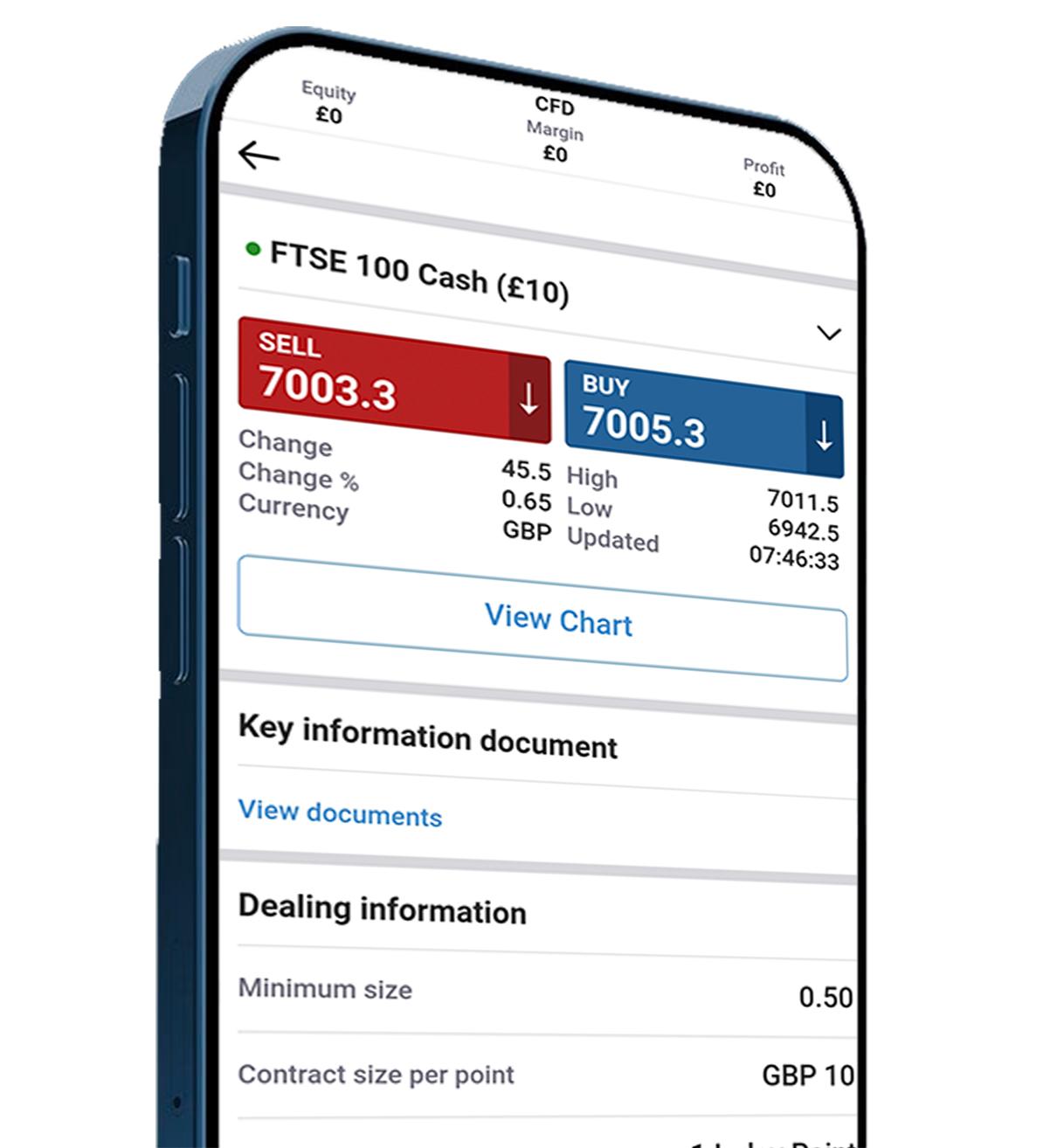

Mobile Trading

Both IG Group trading platforms are available on a mobile app. These are available as a free download and are compatible with iOS and Android devices. Access the tools, features and functionality found on the web trader and desktop terminals. You can manage your account, open and close positions, check live pricing and view charts while on the go.

IG Web Trader App

- Market search tool

- Trade directly from charts

- Create personalised watchlists

- Set alerts direct from economic calendar announcements

- Price movement alerts via SMS, email or push notifications

Note, there are download guides for all platforms and mobile apps on the broker’s website.

IG Accounts

Live Accounts

IG offers account types based on trading markets. The main difference between spread betting and CFD accounts is the way they are taxed. Spread bets are free from capital gains tax while CFD profits can be offset against losses for tax purposes.

Available live accounts will also vary by country of residency. Most countries allow forex, CFD and options trading. Multiple deposit currencies are accepted including USD, GBP, EUR, CAD and AUD. There are no minimum deposit requirements to open a live account, similar vs CMC Markets, though values may vary by payment type.

Getting started with IG Group is straightforward. A simple online registration form is required, with personal details and previous investing knowledge also a mandatory condition. Identity verification is typically confirmed immediately. Alternatively, postal applications are accepted.

Muslim-friendly, swap-free accounts are available for clients adhering to Islamic laws.

Demo Account

IG Group offers a free demo account on the proprietary and MT4 terminals, which is standard practice at established brokers. Users can access up to £10,000 of virtual funds in a simulated real-time trading environment.

Investors can practise swing trading strategies risk-free, learn platform features and view all financial markets. It’s also quick and easy to open a paper trading account with the online form on the company website.

Fees

Trading fees are competitive at IG with the broker building its cut into the market spread. Spread charges apply to CFD trades on all markets except stocks. Shares involve a separate flat commission based on the transaction value:

- US Shares – £10 per trade if 0-2 trades are executed per month. £0 if 3+ trades executed

- UK Shares – £8 per trade if 0-2 trades are executed per month. £3 if 3+ trades executed

- European Shares – 0.1% of transition value per trade irrelevant of previous trading history volume

- Australian Shares – 0.1% of transition value per trade irrelevant of previous trading history volume

Spreads on major forex pairs, including EUR/USD and GBP/EUR, are as low as 0.6 pips. Major indices including the FTSE 100 and Germany 40, are offered from 0.8 points. Note, charges may differ by trading entity.

Spread betting and CFD trading requires an initial deposit margin only, meaning swing trading clients don’t have to pay the full trade value. Regulatory restrictions often cap the maximum leverage available by instrument. For example, clients under the authorisation of the FCA will be offered a maximum of 1:30 on major forex pairs and 1:20 on indices and commodities.

Swap charges also apply to any trades held overnight. Additionally, a 0.3% fee applies to the underlying transaction value if a guaranteed stop is triggered. Finally, a £12 monthly inactivity charge is activated after 24 months of no trading.

IG Payments

Deposits

IG Group offers several fast and free deposit options. Look out for the deposit logo within the client portal. Available payment methods may vary by country but include:

- PayPal – £250 or equivalent currency minimum deposit, instant processing

- Credit/Debit Cards – £250 or equivalent currency minimum deposit, instant processing

- Bank Wire Transfers – no minimum or maximum deposit amount, up to three days processing time

The broker accepts six account base currencies; USD, EUR, GBP, HKD, AUD and SGD. A 0.5% currency conversion fee applies for deposits from a denominated account currency to a base currency.

Withdrawals

The broker supports the same methods for withdrawals though processing times vary. Withdrawals via PayPal are typically instant while bank wire transfers and credit/debit card transactions can take up to five days.

A minimum £100 or equivalent currency withdrawal limit applies for all accounts while a maximum limit of £20,000 per day applies to card withdrawals.

The broker does not charge a fee for any payment method however third-party charges may apply. Identity verification may also be required to comply with AML laws.

Note, when selling equities from an IG Group share dealing or ISA account, a three-day settlement period is applied before funds are available to withdraw. There are no added fees.

IG Regulation

IG Group is regulated by several financial bodies globally. Regulation will vary by country of residency but licenses are held with the following:

- UK – Financial Conduct Authority (FCA)

- UAE – Dubai Financial Services Authority (DFSA)

- Japan – Japanese Financial Services Authority (FSA)

- Germany – Federal Financial Supervisory Authority (BaFin)

- USA – Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA)

Investor protection varies by jurisdiction. Clients under the regulation of the FCA have access to the Financial Services Compensation Scheme (FSCS). Funds are protected up to the value of £85,000 in the case that IG UK Ltd or the holding bank go into liquidation. International clients may also have access to local compensation schemes via the relevant legal entities.

Security

The broker holds client funds in segregated bank accounts to protect traders against business insolvency. European retail clients also benefit from negative balance protection. Two-factor authentication (2FA) is available as an optional security enhancement. Personal and financial data between the IG Group and trading terminals are exchanged via 256-bit SSL encryption.

IG Group Holdings provides a relatively safe and secure trading environment. The firm has a successful history spanning 45 years with several industry awards, including ‘No.1 Overall Broker’ at the Forex.com Annual Review Awards plus the ‘Best Multi-Platform Provider’ at the ADVFN International Financial Awards.

As a broker with top-tier regulation, IG also posts annual financial statements. Prospective clients can access previous earnings results including the IG Group PLC 2018, 2019 and 2020 annual reports. Other accessible investor relations postings include share price drop forecasts, dividend yield history, P/E ratios, and data on assets under management.

Educational Content & Analysis

The IG Group website hosts a dedicated webpage for training and market insights. These are organised into experienced or new trader categories. Clients can access tailored information based on skill levels. The IG Academy is essentially a bank of resources designed to sharpen skills via flexible and personalised courses.

Training materials are available at no extra charge to clients. Popular courses include an introduction to the financial markets (beginner), fundamental analysis (intermediate) and using stops and limits to manage risk (advance). Additional tools available include an investor economic calendar, podcasts, webcasts, YouTube video content, and trade ideas. A trade analysis tool can also be used to explore market data, analyse asset performance and minimise mistakes and risks.

IG Trading Signals

IG Promotions

The broker does not typically offer bonuses to new or existing traders, including welcome offers. Global regulators limit the use of financial incentives.

Note, less stringent authorisations do allow incentives such as referral schemes or no deposit bonuses, but always check the terms and conditions as unrealistic minimum thresholds and withdrawal terms may be set.

Advantages

Reasons to consider trading with IG vs competitors like Interactive Brokers and Forex.com include:

- Advanced trading tools

- 17,000+ assets & markets

- 24-hour customer support

- Free deposits and withdrawals

- Multiple regulatory licenses

- No minimum deposit requirements

- Comprehensive educational content

- Listed on London Stock Exchange (LSE)

- Weekend and out-of-hours trading available

Disadvantages

Downsides to registering with IG include:

- No live chat support

- US clients not accepted

- Limited rewards for loyal customers

- No e-wallet payments including Skrill and Neteller

Trading Hours

IG Group trading hours vary by instrument with typical forex and commodities markets available 24 hours per day between Sunday to Friday. The broker also offers weekend and out-of-hours trading on global indices and some major currency pairs.

A session timetable is available on the broker’s website so users can stay up to date with upcoming public holidays, daily break sessions and market closures.

Customer Service

IG Group’s customer support team are available 24 hours a day from 8 AM (GMT) Saturdays to 10 PM (GMT) Fridays. Contact options include an email address and London head office telephone number. There is no live chat option, however, forum support is available on the app for self-help information and peer-to-peer guidance.

The broker is also present on social media channels including Twitter, LinkedIn and Instagram with regular updates and latest news posts. IG International offers local contact options, varying by jurisdiction.

Verdict

IG is a top contender in the retail trading market. Swing traders can be assured of top-tier regulation, thousands of assets, excellent education tools and responsive customer support. The broker’s services will suit both new and experienced investors with advanced tools available to those wanting to further their trading careers.

FAQ

What Is IG Group?

The company provides trading opportunities to investors worldwide with operations in 20+ countries. Since its launch in 1974, the broker has established itself as a global leader in the retail trading industry, picking up multiple trading and technology awards.

Is IG Group Legit?

Yes, the IG Group is a safe and legitimate brokerage. It operates with relevant regulatory oversight from global bodies and is listed on the FCA register. Other rating sites including Reddit, Trustpilot, Wiki and Motley Fool, also indicate a positive user experience and a responsive customer support team.

What Payment Methods Does IG Group Offer?

You can deposit into your IG Group account via several payment options. These include credit/debit cards, PayPal and bank wire transfers. Head to the account portal to make a transfer.

Is The IG Group Regulated?

Several leading financial agencies regulate the IG Group. These include the UK’s Financial Conduct Authority (FCA) and Dubai’s Financial Services Authority (DFSA).

What Can I Trade With IG Group?

IG offers two main ways to speculate on 17,000+ assets; spread betting and CFDs. With these instruments, clients can take positions on forex, commodities, global indices and more.